Insurance sales people often like to talk about how successful they are. But some agents prefer not to talk about their success, but rather to simply be successful. And when pushed to speak about their accomplishments, they often prefer to credit their customers rather than themselves for their achievements.

The principals of Emrick Insurance Marketing Group fall into the latter group. They’re insurance professionals of few, but profound, words. When asked about their success, they inevitably turn the conversation back to their loyal agent customer base. “The more people you help to become successful, the more successful you will become,” says Brenda Emrick-Kennedy, president of the Emrick agency.

Based in Griggsville, a Western Illinois community of roughly 1,200 people, the agency was established in 1971 by Emrick-Kennedy’s father Roger D. Emrick and his late wife Mary Anne. Initially, they were a retail agency producing for American Republic. But sales volume grew, and Roger Emrick began hiring sub-agents to work for him. In 1994, he began a brokerage operation dedicated to creating a substantial producer client base.

Today, having outgrown two buildings and expanded operations to 25 states, the Emrick agency has carved out a successful niche in the senior insurance marketplace. It has averaged 15% growth over the last 10 years by never forgetting that the quickest and most sustainable path to success is to help their clients –other insurance agents—achieve their financial goals.

Other than having a customer focus, what other factors have produced the agency’s success? One is having the discipline to focus on and develop a narrow niche over many years. “Our claim to fame is the senior sales segment,” says John Emrick, the agency’s CFO. Today, the agency accesses Medicare supplement products from 26 insurance carriers, Medicare Advantage plans from five insurers, and Medicare Part D coverage from several providers. It also distributes long-term care insurance from five carriers, as well as stand-alone home health care and short-term nursing home coverage. Cancer, accident, and specified disease insurance; major medical and short-term medical; and hospital indemnity insurance also occupy important slots in their product portfolio, as does final expense protection. Rounding out their products are life insurance, annuities, and disability income protection.

With so many products on the shelves and with product features that are always changing in response to government mandates, especially with regard to Medicare, contract knowledge has played a pivotal role in the agency’s success over the years. “Our clients expect us to know all about the Medicare insurance industry and to be able to recommend suitable products for their clients, “says CFO John Emrick. But the challenge is even harder than that, he says. “You have to be able to provide a correct answer almost immediately.”

Another success factor has been the agency’s strong value proposition. In other words, the agency knows how to describe the reasons agents should do business with them and has the patience to broadcast this message repeatedly into the marketplace to attract new agents and retain existing customers. It breaks down into five pieces, including:

- Marketing support: Emrick strives to position itself as their customers’ sales partner. They stress that their team consists of agents with over 20 years of field experience whose goal is to provide immediate, reliable information that makes selling and getting new business issued as hassle free as possible.

- Licensing: The agency’s team understands that getting agents contracted is where the rubber meets the road, both for them and the agency. To this end, the Emrick team commits to process all agent contracts on the day they are received.

- Training: As mentioned earlier, knowledge is a recurring theme in everything the Emrick agency does. This holds especially true regarding the training seminars it provides to customers. Like most brokerage agencies or insurance marketing organizations, disseminating product knowledge is crucial. So is building capability in client needs assessment and product selection. Finally, the firm recognizes that training should be customized to the precise needs of their audience. Which means it can’t be too complex for newbies or too simple for those with experience. Regardless of their tenure, Emrick’s clients can access training that meets them where they are today.

- Rewards: Recognizing clients who are outstanding sales partners is an integral part of the Emrick value proposition. So it offers an array of incentives, bonuses, and other rewards that capture producer imagination and reward them for superlative performance.

- Service: Although left for last, agent service may well be the most important thing Emrick offers. The principals recognize that service is what attracts agents to their firm, and service is what keeps them loyal for decades. “Our agents never get an answering machine when they call,” says Emrick-Kennedy. “They always get a human being to give them an immediate answer. And we always bend over backwards to do what we can to help them succeed.

“This explains why our agents stay with us,” she adds. “And why we get a lot of referrals.”

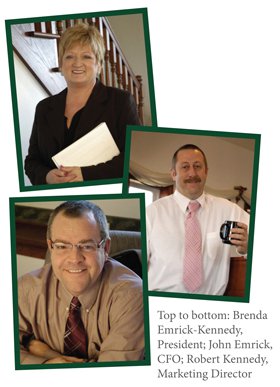

A final success factor has been the agency’s closely-knit management team and staff, working in a family-business environment. After Roger and Mary Anne Emrick formed the agency in 1971, daughters Elizabeth Emrick and Brenda Emrick-Kennedy came on board as sales representatives in 1978. Four years later, their brother John Emrick joined the firm. Today, the management team consists of Brenda, John, and Robert Kennedy, who serves as marketing director. Rounding out the team are Michelle Perry, data specialist; Allison Felion, new business manager; and Alexis Bellovich, administrative assistant. Following in the footsteps of Roger and Mary Anne, the current team exhibits the same commitment to excellence the firm’s founders did decades ago, all geared to delivering their service promise to the hundreds of agents they serve every year.

Although the principals of Emrick Insurance Marketing Group are people of few words when it comes to describing their own success, they gladly share simple, yet profound, advice for new agents wanting to make their mark:

- Always strive for consistency. Perform at the same level for all of your clients. Show up for work and leave at the same time every day. Show clients they can count on you to deliver on your promises.

- Sweat the details of client needs assessment and product selection. This is the core of the insurance business. If an agent can uncover pressing customer needs and fulfill them with a suitable product, then he or she will have industry staying power. According to John Emrick, the potential mistakes are many. “Sometimes agents try to sell the wrong product to a client or recommend the right product, but from the wrong company. We try really hard to catch such mistakes before they hurt a client,” says Emrick. “We even scrub agent applications prior to submitting them.”

- Commit fully to the business. Robert Kenney, the firm’s marketing director, advises new agents to devote a lot of time to growing their books in the first few years. “It doesn’t come easy,” he says. “But if you focus and work hard, your business will provide a lifetime income. If everyone could do it, it wouldn’t be a good business.” What’s more, he urges new agents to be strong self-starters. “They need to motivate themselves to get out of bed and go to work.” But they must also develop a thick skin to handle rejection. “When prospects say no, they’re not rejecting the agent,” Kennedy points out. “They’re either saying no to the product or to the presentation. Agents just need to hang tough.”

- Become a student of the business. This means staying on top of industry news, product trends, regulations, and the like. For example, producers who closely follow what’s happening with Medicare insurance know that short-term nursing care is a hot product these days. “Because of changes in regulations, Medicare is no longer covering certain expenses,” says Brenda Emrick-Kennedy. “This makes short-term nursing home one of the more compelling products for baby-boomers in the current environment, “she says.

- Pick the right marketing partner. All of Emrick’s principals agree that having a great marketing partner is half the battle in agents becoming successful these days. They need experts behind them to sweat the details that might otherwise cause problems down the road.

- Protect yourself from unforeseen disputes. Even with a strong marketing partner, new agents can still make mistakes that spark customer conflict and damaging E&O insurance claims. To preserve their assets, agents should consider buying high-quality E&O insurance coverage from a highly rated insurer. “When our agents ask us whom they should use for E&O, we always send them to the National Association of Professional Agents (NAPA),” Emrick-Kennedy says.

At the end of the day, what does success mean to the folks at Emrick Insurance Marketing Group? For agents, it boils down to having someone who knows the business, the products, and the procedures and who will work hard to make them look good. In typical Emrick “keep it simple and short” fashion, Brenda Emrick-Kennedy describes it this way: “Agents just need to partner with someone who knows their stuff.”