TOPICS

Insurance Agent Posts

Jan 23, 2023

Cyberattacks and data breaches are the new normal for insurance agents and agencies. Here’s some basic information that will reduce cyber risks for insurance agents. For decades, insurance agents and agencies have done business continuity planning to ensure they can operate during— or recover...

Insurance Agent Protection

Insurance Agent Protection

Sep 14, 2022

Think you don’t need cyber liability and data breach insurance? With cyber losses mounting, it might be time to reconsider. Many insurance agents don’t think they need cyber liability and data breach insurance. They believe their business is too small to be at risk or their cybersecurity plan...

Insurance Agent Protection

Insurance Agent Protection

Mar 16, 2021

The COVID-19 pandemic rewrote 2020’s cybersecurity playbook. Are you ready for what’s coming next? Cyberattacks, an issue that has plagued businesses for years, became a mortal threat in 2020. Because most U.S. businesses shifted to remote work due to the COVID-19 pandemic, this opened the...

Insurance Agent Protection

Insurance Agent Protection

Sep 3, 2020

Data breaches are a HIPAA nightmare in the making. Are you fully aware of your cyber risks...and of how you can help to mitigate them? “It will never happen to me.” So say many US physicians about healthcare data breaches, a common phenomenon in today’s tech-enabled medical field. But happen...

Insurance Agent Protection

Insurance Agent Protection

Jul 15, 2020

Most associate a business that is under attack with physical theft of products or assets. However, cybercrime is an extremely real and costly occurrence that takes place in the U.S. far more than you might think. A breach in sensitive business data can result in such a severe loss, the company may...

Insurance Agent Protection

Insurance Agent Protection

Jun 23, 2020

With the rise in online business activities over the past decade or so, cybersecurity has become one of the top concerns for individuals, businesses, and entities like hospitals and government agencies. During crises such as the Coronavirus pandemic, though, cybercriminals tend to pounce even more...

Insurance Agent Protection

Insurance Agent Protection

Jun 3, 2020

As the technology of the world continues to rapidly develop and change, businesses are at risk of cybercrime now more than ever. And while that word may sound futurist and unthreatening, there are real dangers associated with being the victim of cybercrime, both financially and professionally. If...

Insurance Agent Protection

Insurance Agent Protection

May 15, 2020

With the Coronavirus wreaking havoc around the world, various measures are being enforced to try and reduce the spread of this deadly illness—one of which is an order to stay home, unless you need food or medical attention, or in the event of an emergency. But, while many companies are allowing...

Insurance Agent Protection

Insurance Agent Protection

Jan 10, 2020

The end of the year and the beginning of the next are busy times for small business owners. But don’t let this distract you from your cybersecurity best practices. The end of one year and the beginning of the next can be a wonderful time for owners of small-to-medium (SMB) sized business. It’s...

Insurance Agent Protection

Insurance Agent Protection

Oct 2, 2019

There's no better time than National Cybersecurity Awareness Month to consider your firm's cyber risks. But don’t just think about them... take appropriate defensive actions!ver Cyber crime and accidental data breaches happen to small-and medium-sized businesses (SMBs) every day... with...

Insurance Agent Protection

Insurance Agent Protection

Apr 9, 2019

Financial professionals such as insurance agents, investment advisors, or real estate agents aren’t immune to IRS-related scams. You may think your tax return is safe because you’re more sophisticated than the average consumer. But it’s not, because you’re sitting on significant amounts of...

Insurance Agent Protection

Insurance Agent Protection

Apr 1, 2019

In October of 2017, the National Association of Insurance Commissioners (NAIC) adopted the Data Security Model Law (Model Law) that requires insurers and other entities licensed by state insurance departments to develop, implement, and maintain an information security program. The model law closely...

Insurance Agent Protection

Insurance Agent Protection

Oct 8, 2018

Is it any surprise cybercriminals are targeting the financial-services industry? Banks and investment firms hold deposits worth trillions of dollars from hundreds of millions of consumers. Breaching their defenses can yield stupendous paydays for today’s cybercriminals. Meanwhile, insurance...

Insurance Agent Protection

Insurance Agent Protection

Jun 4, 2018

South Carolina Governor Henry McMaster signed an insurer data security bill into law on May 14, 2018, making the state the first in the nation to enact a version of the NAIC Insurance Data Security Model Law. The law will become effective on January 1, 2019 and apply to insurance companies,...

Insurance Agent Protection

Insurance Agent Protection

Apr 16, 2018

Once you have a cyber risk plan in place, what’s next? Execute the best practices available for keeping your firm and clients safe. Although there are entire college courses and shelves of books devoted to this topic, here are 11 of the key things you should do, according to leading experts....

Insurance Agent Protection

Insurance Agent Protection

Apr 9, 2018

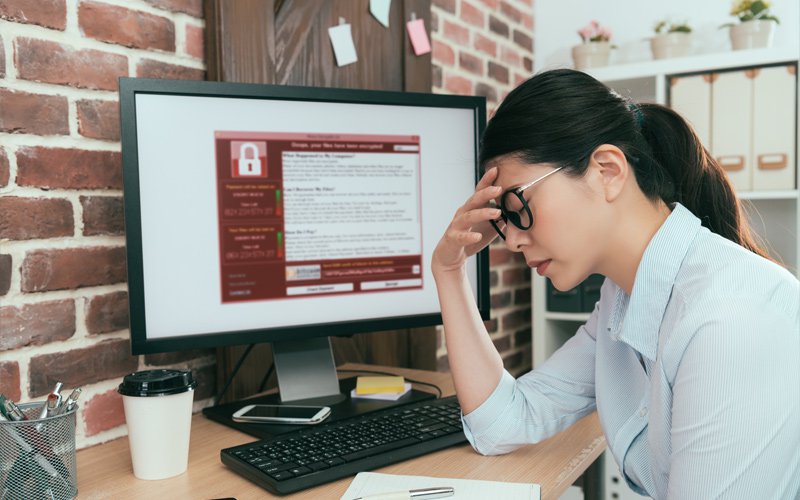

For financial professionals, 2017 may go down in history as the year they got serious about cybersecurity. After a series of major hacks hit the news (Equifax, WannaCry Ransomware), the number of total data breaches exploded (reaching 1,293 incidents). Regulators began applying more pressure, and...

Insurance Agent Protection

Insurance Agent Protection

Feb 12, 2018

As cyber-breaches continued to afflict U.S. businesses in 2017, both small and large-sized businesses continue to give data security a big priority. That’s the takeaway from a recent survey by USI Insurance Services. However, according to its 2017 Cyber Security and Data Privacy Study, the top...

Insurance Agent Protection

Insurance Agent Protection

Feb 5, 2018

True to its inherent conservatism, the insurance industry has adopted a slow and steady approach to managing cyber risks. Insurers have created new forms of insurance to deal with cyber breaches, and regulators have begun to provide a legal framework for reducing industry exposure to major losses...

Insurance Agent Protection

Insurance Agent Protection

Jan 3, 2018

At a loss about how to best protect your business against cyber breaches? Then help is on the way. On October 11, 2017, the U.S. House of Representatives approved a law that would provide guidance to small businesses, including insurance agencies and financial-services consulting firms, on how to...

Insurance Agent Protection

Insurance Agent Protection

Nov 2, 2017

The recent Equifax data breach has millions of Americans scratching their heads, wondering how to best lock down their finances against foreign hackers armed with their personal information. According to Dave Sather of Sather Financial, consumers need to move beyond thinking that one year of...

Insurance Agent Protection

Insurance Agent Protection

Oct 9, 2017

Despite relentless media coverage, fewer than half of advisors (44 percent) say they fully understand cybersecurity risks and even fewer (29 percent) say they’re prepared to manage and mitigate the risks they face. These were two key findings from a Financial Planning Association (FPA) Research...

Insurance Agent Protection

Insurance Agent Protection

Oct 2, 2017

The popular image of hackers in foreign lands stealing customer data chills the blood of agents, advisors, and insurer company executives alike. However, even though the threat of malicious attacks remains high, there’s an equally high risk of self-inflicted wounds, according to Beazley Breach...

Insurance Agent Protection

Insurance Agent Protection

Sep 18, 2017

Cyber criminals have hacked the credit reporting agency Equifax, exposing personal information of over 143 million consumers including Social Security Numbers, date of birth, addresses and some driver’s license numbers. A large percentage of all adults in the U.S. were impacted, as well as...

Insurance Agent Protection

Insurance Agent Protection

Aug 28, 2017

With data breaches at an all-time high—1,093 in 2016 alone, according to the Identity Theft Resource Center—regulators have gotten religion on the cyber-security issue. Over the last two to three years, they’ve conducted surveys, updated their examination protocols and issued enforcement...

Insurance Agent Protection

Insurance Agent Protection

Jul 24, 2017

Each day seems to bring more news of cyber-attacks and breaches that cripple businesses around the world. But if you’re like most insurance agents and financial advisors, at a certain point you just have to move on from these events to the work that drives your business forward—approaching...

Insurance Agent Protection

Insurance Agent Protection

Jun 1, 2017

Insurance agents and brokers licensed to operate in New York have a new regulatory concern these days: how to comply with the Empire State’s new cybersecurity regulation. The new rule, reportedly the first in the nation, went live on March 1, 2017. The product of a three-year rule-making...

Insurance Agent Protection

Insurance Agent Protection

May 25, 2017

As an independent financial-services professional, you’re only as good as your data . . . the knowledge in your head and the information stored on your computer. As long as you have access to these resources, you can work for anyone, from anywhere and be as successful as you wish to be. Want to...

Insurance Agent Protection

Insurance Agent Protection

Apr 25, 2017

Don't make the mistake of thinking that as an independent insurance agent you are immune to a data breach. 62% of cyber-breach victims are small to mid-size businesses. Here are the top four cyber security myths that independent agents believe: .embed-container { position: relative;...

Insurance Agent Protection

Insurance Agent Protection

Apr 18, 2017

There’s a lot of speculation about what the healthcare industry can expect in 2017. With the presidential election recently behind us and key positions throughout the government changing, privacy and security are likely to remain a hot topic. Tom Price M.D. was nominated as the United States...

Insurance Agent Protection

Insurance Agent Protection

Apr 13, 2017

Tip One: Establish Privacy Policies One of the first things you can do to get on the right side of HIPAA requirements is to establish privacy policies. These policies need to be enforced and implemented properly, but they should also be documented carefully. In the event that the privacy policy is...

Insurance Agent Protection

Insurance Agent Protection

Jan 12, 2017

Data breaches, like taxes, are inevitable. No business or organization is immune. Dealing with cyber threats and staying compliant with government and industry requirements is now an inherent risk of doing business for insurers, brokers, agents and other related businesses. While some in insurance...

Insurance Agent Protection

Insurance Agent Protection

Apr 27, 2016

The following 8 steps will help you properly assess your current electronic communication security situation, provide you with guidance to implement appropriate measures and shield your data from being exposed or exploited. Understand regulatory compliance requirements – to begin planning a...

Insurance Agent Protection

Insurance Agent Protection

Apr 27, 2016

The job of a Chief Executive Officer (CEO) is becoming more difficult every year. Today, in addition to being strategic visionaries and leaders, most CEOs must deal with complex legal issues surrounding their organizations. More often they are being held personally responsible for mistakes made by...

Insurance Agent Protection

Insurance Agent Protection

Jun 30, 2015

The National Association of Professional Agents (NAPA) announced today the launch of a comprehensive Data Breach Compliance and Certification Program specifically designed for independent contractors, agencies and small businesses. .embed-container { position: relative; padding-bottom: 56.25%;...

Insurance Agent Protection

Insurance Agent Protection

Mar 16, 2015

The number of data breaches rose tremendously last year from the year before. According to a report by digital security firm Gemalto, nearly one billion data records were compromised in 1,500 attacks in 2014 – a 78 percent increase in the number of data records either lost or stolen in 2013. This...

Insurance Agent Protection

Insurance Agent Protection

Jan 28, 2015

Recent data breaches affecting businesses of all sizes have raised consumer awareness. Smaller businesses are more likely to suffer the consequences because there are fewer resources and employees at their disposal. With the loss or theft of just 1,000 client records from a lost or stolen laptop, a...

Insurance Agent Protection

Insurance Agent Protection

Oct 1, 2014

Staying ahead of cyber-crime is more important now than ever In this edition of your monthly newsletter, we look at the largest theft of digital data so far, safeguards against hackers and a few interesting articles from around the web. As reported by Nicole Perlroth and David Gellesa in The...

Insurance Agent Protection

Insurance Agent Protection

Aug 26, 2014

Data breaches have become more and more common over the last several years. According to a report from the U.S. Justice Department, about 16.6 million people were affected in 2012. Credit cards (40 percent) and bank accounts (37 percent) were the most common types of misused information. The...

Insurance Agent Protection

Insurance Agent Protection

May 8, 2014

Companies of all sizes rely on critical business data in order to be successful. Based on a Trend Micro-sponsored Ponemon Institute study, more than 78 percent of organizations have suffered at least one data breach over the past two years with another 13 percent being unsure of an attack. Even...

Insurance Agent Protection

Insurance Agent Protection

Feb 6, 2014

Find out how large corporations like Target, Neiman Marcus and others have recovered from data breach in the past year. Image taken from the Wall Street Journal Jan. 13, 2014 Large corporations like Target, Neiman Marcus and numerous other retailers have had some form of a data breach in the...

Insurance Agent Protection

Insurance Agent Protection

Oct 22, 2013

As you may know, cyber security is a big issue. It doesn’t take someone being technically sophisticated to become a cybercriminal. Breaches are caused by everything from lost, discarded, or stolen laptops, PDAs, smartphones, and portable memory devices, to innocent procedural errors and acts of...

Insurance Agent Protection

Insurance Agent Protection

Dec 18, 2012

Identity theft has become a growing concern across the United States as one in 23 people are victims of identity theft. According to a 2009 Federal Trade Commission (FTC) report, 69% of identity theft events were non-financial, which include medical, insurance, evading the law, government document...

Insurance Agent Protection

Insurance Agent Protection